Many individuals fear running out of money in retirement. However, by being responsible with regards to savings for this goal and being disciplined about saving regularly over time can help ensure a financially secure retirement. Estimating future expenses will give you an accurate picture of how much savings is necessary, helping set annual and monthly …

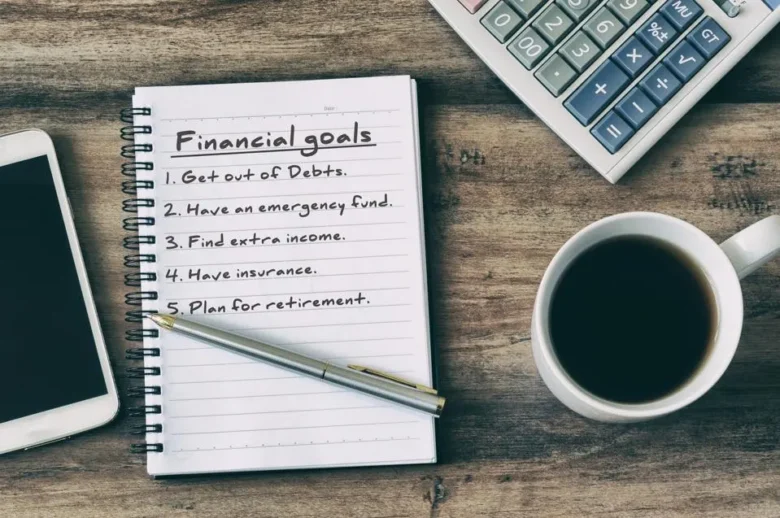

Personal finance refers to the practice of managing one’s money. This encompasses aspects such as budgeting, saving and investing as well as setting financial goals and clearing off debt. Everybody should aim to save an equivalent of their income. To do this, they should track their spending for several weeks – be it via apps, …

Learning how to manage your money can be a lifetime journey; take it step-by-step and adjust as necessary. Spend less than you earn, saving for what matters most and paying down debt at the same time. Doing this will help to secure the future and reduce debt loads. Impulsive purchases can put an end to …

Financial Planning can assist in reaching all your financial goals – be they contributing to a 401(k), saving for retirement, purchasing a home or managing debt responsibly. Financial planning is an ongoing process of evaluating your current financial status and creating strategies to achieve long-term goals. This may involve goal setting, cash flow analysis, budgeting, …

Living with debt can be stressful, overwhelming, and even paralyzing. Whether it’s credit cards, student loans, personal loans, or medical bills, being in debt often feels like your money is controlling you, instead of the other way around. But here’s the good news: you can break free. With smart strategies and a clear plan, you …

An emergency fund is like a safety net to protect your money; it helps you when life throws you unnecessary expenses. Having cash on hand can help you avoid debt and give you peace of mind in case of emergencies, such as a hospital bill, car repairs, or a sudden job loss. However, building an …

Investing is one of the most effective ways to build wealth and secure your financial future. But if you’re new to the world of investing, it can seem overwhelming, confusing, or even risky. The good news? You don’t need to be a stock market expert or have thousands of dollars to get started. Whether you’re …

It’s harder than ever to keep track of money these days. It can be hard to keep track of everything when you have bills, savings goals, debts, and changing costs. Thanks to technology, managing personal finances has become easier. For example, mobile apps can help people take charge of their money. There is an app …

Personal finance might feel overwhelming, but it doesn’t have to be. Building wealth and achieving financial freedom is a journey that starts with understanding the basics and taking consistent action. Whether you’re drowning in debt, living paycheck to paycheck, or looking to optimize your existing financial strategy, the principles remain the same. Financial freedom means …

For an enjoyable retirement, it’s vital that you plan ahead. Raymond James advisors can assist with understanding your retirement goals and creating an ideal savings strategy to help achieve them. Idealy, saving should begin early in your career via retirement accounts that offer tax advantages. Furthermore, learning about investing can help ensure your funds can …