Financial Planning can assist in reaching all your financial goals – be they contributing to a 401(k), saving for retirement, purchasing a home or managing debt responsibly. Financial planning is an ongoing process of evaluating your current financial status and creating strategies to achieve long-term goals. This may involve goal setting, cash flow analysis, budgeting, …

Investing is one of the most effective ways to build wealth and secure your financial future. But if you’re new to the world of investing, it can seem overwhelming, confusing, or even risky. The good news? You don’t need to be a stock market expert or have thousands of dollars to get started. Whether you’re …

It’s harder than ever to keep track of money these days. It can be hard to keep track of everything when you have bills, savings goals, debts, and changing costs. Thanks to technology, managing personal finances has become easier. For example, mobile apps can help people take charge of their money. There is an app …

Many people think that only the rich can spend, but that’s not true. You don’t need a lot of money to grow your wealth. Anyone can start building a financial portfolio, even those with little money, as long as they have the right mindset, some basic knowledge, and the right tools. One of the …

As you age, your financial tasks and desires evolve. The way you handle your money should change depending on your situation from the time you get your first paycheck until you leave. Planning your finances is an ongoing process that lasts a lifetime. At each stage of life, there are different goals, risks, and chances. …

Life is hard to plan for. One minute you’re doing well with your money, and the next thing you know, you have a sudden medical bill, car repair, job loss, or home problem. Life is full of shocks like these, which is why everyone and every family needs an emergency fund. When something unexpected happens …

Why Budgeting Matters More Than You Think A monthly budget is more than a spreadsheet—it’s a plan for how you’ll use your money to achieve what matters most. Whether you’re trying to get out of debt, save for a big goal, or just stop living paycheck to paycheck, a working budget puts you in control. …

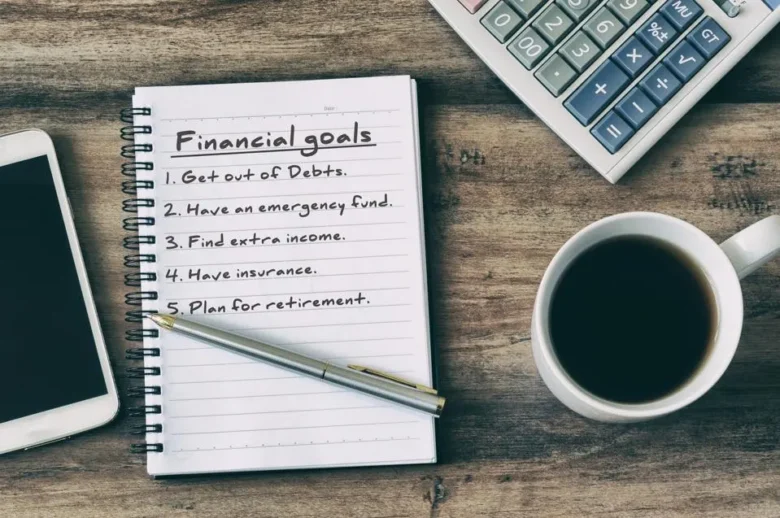

Before you start spending money, it’s important to plan your finances so you don’t make the wrong decisions. But everyone has different financial goals. Some goals are short-term, like things you want to accomplish in the next few months or years. Others are long-term, meaning they could take five, ten, or even thirty years to …

Good Financial Goals and Why They Matter People don’t just get rich. Clear goals and careful planning are the first step. Setting smart financial goals will help you build wealth over the long term, stay financially healthy, and give you direction. Without goals, it’s easy to spend mindlessly or spend more than you earn. With …