Financial Planning can assist in reaching all your financial goals – be they contributing to a 401(k), saving for retirement, purchasing a home or managing debt responsibly.

Financial planning is an ongoing process of evaluating your current financial status and creating strategies to achieve long-term goals. This may involve goal setting, cash flow analysis, budgeting, investment strategy planning and risk management strategies.

Goal Setting

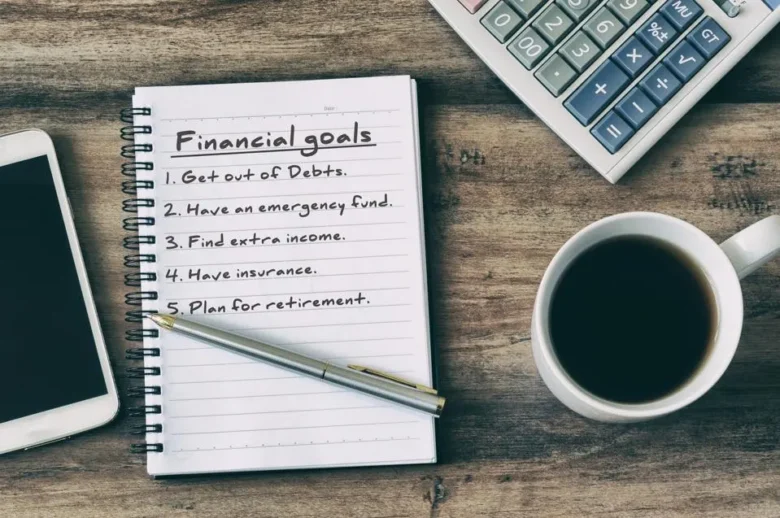

Setting financial goals is an integral component of creating a financial plan. These goals can help you identify expenses, build an emergency fund and save for future needs while serving as motivation to stick to your budget and give a sense of fulfillment when reached.

As part of financial goal setting, it’s essential to first assess your current spending habits. Doing so will give a truer picture of what’s coming and going while also uncovering any opportunities to increase savings or reduce debt faster.

Assign near-term goals that you can meet quickly. These might include creating a budget, paying down credit card debt or saving for a vacation. Midterm goals might involve financing the cost of homebuying or college education while long-term investments might include opening an IRA account or other tax-deferred investments. All goals should be specific, measurable, achievable, relevant and timely (SMART).

Cash Flow Analysis

Cash flow analysis allows business owners to assess whether or not there is enough cash coming in to cover short-term expenses and debt payments, and leave enough over for investments into future growth of their company. It also indicates any cash flow issues which need addressing, such as high inventory levels or consistently paying more in customer bills than you receive back in payments from them.

Cash flow analysis involves reviewing a company’s statement of cash flows, which details all sources and uses of cash over an accounting period. It can either be conducted directly – looking at cash receipts and payments – or indirectly by adjusting net income from income statements for non-cash items like depreciation and changes in working capital accounts.

Substantive cash flow analysis involves more extensive calculations, such as operating cash flow/net sales ratios, to gain greater insight into a company’s profitability and sustainability. Sensitivity analysis and scenario planning are also effective strategies that enable businesses to anticipate potential cash flow challenges or surpluses and plan accordingly.

Budgeting

Budgeting is the practice of developing a financial plan to manage income and expenses. Budgeting allows individuals or organizations to allocate resources more effectively while preventing overspending, encouraging savings, and helping achieve long-term financial goals.

Establishing clear objectives that are measurable, attainable, relevant and time-bound is the first step of budgeting. Doing so ensures that the budget reflects organizational goals while providing an ideal basis for decision making. Engaging key stakeholders during the budgeting process increases accountability in reaching goals more easily.

Debt management is another essential element of financial planning, requiring setting aside funds specifically for debt repayment and creating a structured approach towards becoming debt free.

Budgeting can be done annually, monthly or quarterly and should include projections of revenue and expenses such as rent and utilities as well as variable costs such as labor or program expenses. A budget may also include capital expenses like purchasing equipment or buildings.

Investments

Financial investment planning involves managing and growing your money to achieve specific goals, such as funding a college education for your child or saving for retirement. Furthermore, investing planning can also help mitigate risks such as inflation and market fluctuations.

Investment financial planning involves understanding your risk tolerance, time horizon, and financial readiness. You can do this on your own with inexpensive online tools or engage an investment professional for guidance; fees could include either a flat fee, percentage of assets managed fee or both options.

Financial investment planning enables you to grow your investments at a rate greater than inflation. One strategy for doing this is diversifying your portfolio and taking a long-term approach when investing. Doing this will reduce the effects of unexpected economic events or market fluctuations on your investments while protecting them against unexpected events such as tax-efficient vehicles like retirement annuities.

Taxes

Taxes require year-round consideration as part of financial planning. Acknowledging which accounts are taxed differently, how your assets are positioned within them and their effects can help inform more informed decisions.

Taxes play a central role in financial planning – from mitigating investment returns, creating tax-efficient charitable giving vehicles, understanding asset sale timing and helping clients understand its implications, to finding ways to minimize taxes for heirs – they all play a critical role.

Tax-savvy advisors understand this means incorporating tax-effective strategies into every plan they create for clients, providing accurate understandings of how assets are positioned to meet goals accurately and providing advice about implementation based on available technology – an advisor is best placed to do this by consolidating and viewing all client accounts at one place, uncovering hidden tax liabilities, and providing recommendations for implementation that deliver real value and enhance outcomes for them.