The Importance of Financial Management in Everyday Life

Managing your money well is one of the most essential life skills. Whether you earn a fixed salary or have irregular income, knowing how to control your finances can improve your quality of life and reduce financial stress. Effective money management allows you to cover your needs, save for future goals, and enjoy your earnings without falling into debt. It’s not about how much you make—it’s about how you handle what you have.

Understand Your Total Income

The first step in effective financial management is knowing exactly how much you earn. This includes your main salary, freelance income, rental earnings, side gigs, or passive income from investments. It’s crucial to focus on net income, which is the amount left after taxes and other deductions.

Tracking your monthly income gives you a realistic starting point for building a financial plan. If your income is inconsistent, it’s helpful to calculate an average based on the last three to six months to create a more stable monthly budget.

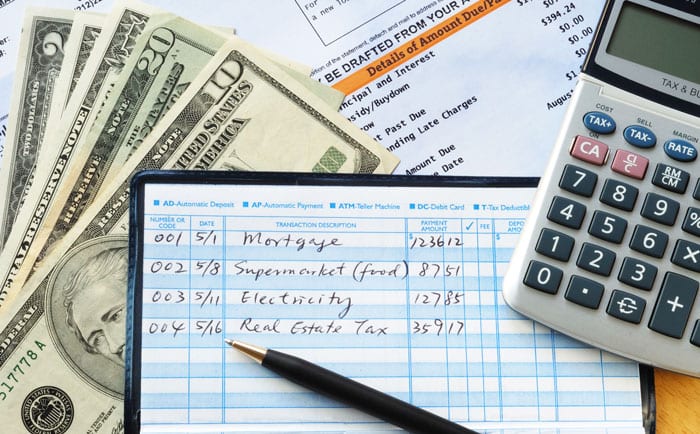

Categorize and Track Your Expenses

Most people are surprised when they start tracking every expense. Small purchases like coffee, snacks, or streaming subscriptions can add up quickly. To manage your money effectively, you need to understand exactly where it’s going. Break your expenses into categories such as:

- Fixed expenses: rent, mortgage, insurance, utilities

- Variable expenses: groceries, gas, entertainment

- Discretionary expenses: dining out, shopping, hobbies

Keep track of every transaction for at least one month. You can use a budgeting app, a spreadsheet, or even a notebook. This process creates financial awareness and helps identify areas where you’re overspending.

Create a Realistic Monthly Budget

A budget gives you a plan for how to use your income wisely. Start by subtracting your total monthly expenses from your income. If the result is negative, you’re spending more than you earn, and changes must be made. If it’s positive, you have room to save and invest.

Allocate your income to needs, wants, and savings. A popular model is the 50/30/20 rule:

- 50% for essentials

- 30% for discretionary spending

- 20% for savings and debt repayment

Adjust the percentages based on your financial goals. A budget only works if it reflects your actual lifestyle and spending patterns.

Prioritize Savings Before Spending

One of the most powerful financial habits is to pay yourself first. Instead of waiting to save what’s left over at the end of the month, allocate a portion of your income to savings right after you get paid. Set up automatic transfers to a separate savings account to build consistency.

Your savings should support several goals:

- Emergency fund (3–6 months of expenses)

- Short-term goals (vacations, car repairs)

- Long-term goals (home, retirement, education)

Even small, regular contributions can grow significantly over time through compound interest.

Build and Maintain an Emergency Fund

An emergency fund is a financial cushion that protects you from unexpected setbacks like job loss, medical bills, or car repairs. Without savings, a single surprise expense can derail your budget or lead to debt.

Start with a goal of $500 to $1,000 if your budget is tight, then gradually grow your emergency fund to cover at least three to six months of essential expenses. Keep this fund in a separate, easily accessible account, and only use it for true emergencies.

Avoid and Manage Debt Wisely

While some types of debt, like a mortgage or student loans, can be necessary, high-interest consumer debt can quickly become a burden. Managing your money effectively means minimizing unnecessary debt and paying off what you owe as soon as possible.

Focus on credit card balances, personal loans, or buy-now-pay-later services. Create a repayment plan using either the snowball method (paying off the smallest balances first) or the avalanche method (paying off the highest interest rates first). Always make at least the minimum payments on time to avoid penalties.

Monitor and Adjust Regularly

A budget is not a one-time task—it’s a living system that needs regular review. At the end of each month, look at your actual income and expenses. Compare them to your budget and identify any areas where you overspent or underspent.

Life circumstances can change—income increases, new expenses arise, goals shift—so make sure your financial plan evolves too. Regular check-ins ensure you stay on track and make smart adjustments as needed.

Use Tools to Simplify the Process

Managing money doesn’t have to be complicated. Use digital tools to make tracking, budgeting, and saving easier. Apps like Mint, YNAB, PocketGuard, or Goodbudget can automate tracking, give spending alerts, and visualize your progress.

You can also use online spreadsheets or templates if you prefer a manual approach. What matters is choosing a system that you’re comfortable with and using it consistently.

Set Financial Goals and Stay Motivated

Money management becomes more meaningful when tied to specific goals. Are you saving for a home, a vacation, or early retirement? Set short-term, mid-term, and long-term financial goals with clear deadlines and amounts.

Having goals makes it easier to stay disciplined and motivated. You’re more likely to resist impulse purchases when you know the money could go toward something that truly matters to you. Celebrate small milestones along the way to stay encouraged.

Avoid Lifestyle Inflation

As your income grows, it can be tempting to spend more—this is known as lifestyle inflation. While it’s natural to upgrade your life a bit, unchecked spending can quickly erase the financial progress you’ve made.

Instead, aim to increase your savings and investments along with your income. For every raise or bonus, consider putting a portion into savings or paying off debt before increasing your lifestyle expenses.

Practice Mindful Spending

Effective financial management isn’t just about numbers—it’s also about mindset. Practicing mindful spending means being intentional about how you use your money. Before making a purchase, ask yourself if it aligns with your values, goals, and budget.

This doesn’t mean you can’t spend on fun or luxuries. It simply means doing so with awareness and purpose. Mindful spending helps you avoid buyer’s remorse and make choices that bring real satisfaction.

Conclusion: Take Control of Your Finances One Step at a Time

Managing your income, expenses, and savings doesn’t require complex math or fancy tools—it just takes commitment, awareness, and consistency. By tracking what you earn and spend, creating a budget, and prioritizing savings, you’ll develop habits that lead to financial freedom.

Start small, take one step at a time, and don’t worry about being perfect. Each decision you make today shapes a more stable, stress-free, and empowered financial future. The sooner you start, the more control you’ll gain over your money—and your life.