Compound interest is often referred to as one of the most powerful tools in personal finance—and for good reason. Unlike simple interest, which only earns interest on the original amount (or principal), compound interest builds wealth by earning interest on both the initial principal and the accumulated interest over time. This snowball effect allows your …

A financial plan is not a one-size-fits-all formula. Everyone’s life is different, with unique goals, priorities, income levels, and values. Creating a financial plan that actually fits your lifestyle ensures that you’re working toward your goals in a realistic, manageable way. Whether you’re a freelancer, full-time employee, entrepreneur, student, or stay-at-home parent, your financial plan …

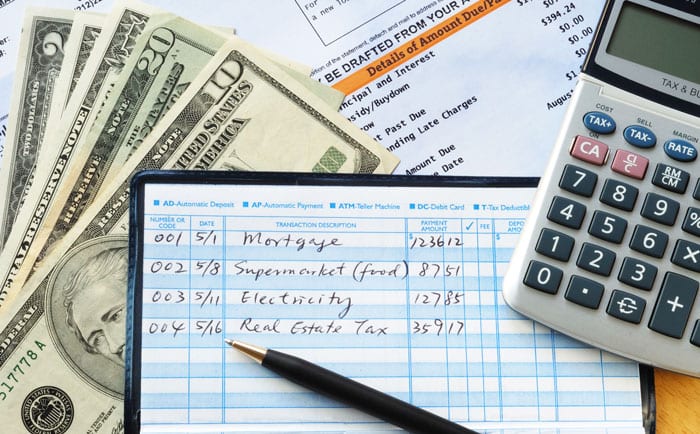

The Importance of Financial Management in Everyday Life Managing your money well is one of the most essential life skills. Whether you earn a fixed salary or have irregular income, knowing how to control your finances can improve your quality of life and reduce financial stress. Effective money management allows you to cover your needs, …

The financial world for millennials and Gen Z is very different from the world their parents lived in. Financial knowledge has never been more important than it is now, with rising costs of living, student loan debt, unstable job markets, and the rise of digital banking and investments. To be successful and stable in the …

Financial literacy is the set of skills and information you need to make smart choices about your money. It means knowing how to set short-term and long-term financial goals, make a budget, save money, trade, and handle debt. Many people think of experts or businesspeople when they think of financial literacy, but everyone needs it, …

Financial success doesn’t come from luck or one-time windfalls—it’s the result of consistent and intentional habits built over time. Just like exercising regularly leads to physical fitness, managing money wisely every day leads to financial health. Strong financial habits are the building blocks that make it possible to get out of debt, buy a home, …

Budgeting is one of the simplest yet most powerful tools for gaining control of your money. Whether you earn a little or a lot, knowing exactly where your money goes helps you avoid debt, reduce financial stress, and build a stable future. Many people think budgeting means restriction or sacrifice, but it’s really about freedom—the …

Nearly every aspect of life is impacted by money, ranging from one’s place of residence to how they manage emergencies. Yet many people go through life without a clear understanding of how to manage their finances. Without a plan, it’s easy to fall into debt, live paycheck to paycheck, or feel constant stress about money. …

To save money, pay off debt, or feel more in control of your finances, start by tracking your expenses. Most people think they know where their money goes—until they start tracking it and see the truth. Expense tracking brings awareness, and awareness brings change. It shows you what you’re spending, where you’re overspending, and how …

There are more factors than just numbers that influence every business decision we make. How we spend money is influenced by many factors, including how we feel, our habits, how others see us, and our deepest beliefs. Behavioral finance digs deeper into the real reasons behind people’s behavior, rather than just focusing on income, expenses, …